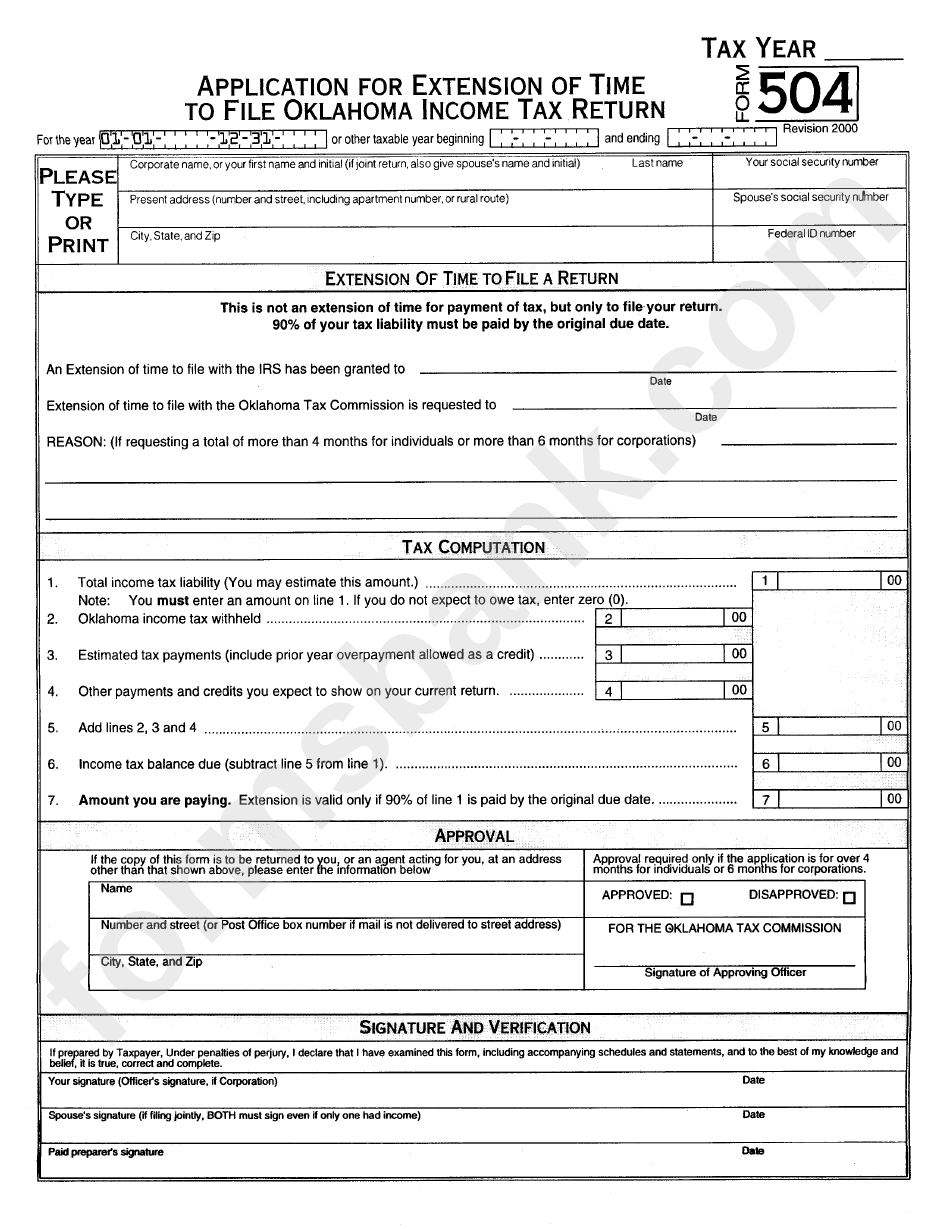

To determine what you still owe, subtract any amount you’ve already paid toward taxes. The IRS offers a tax calculator to help you figure out your total tax obligation using your pay statements most recent tax return. Use last year’s tax return, along with your W-2 and forms for other income sources (such as 1099s) to estimate. When you file your extension, you’ll need to include an estimate of your taxes owed on the form, which can help you determine the payment amount you should submit when filing. When filing for an extension by mail, make sure you have proof that you submitted the form on or before the April 18 deadline to avoid any penalties. You can submit your payment via check or money order, using the instruction on the form. You’ll need to estimate your tax liability to determine if you owe anything when filling out the form.

Tax extention filr how to#

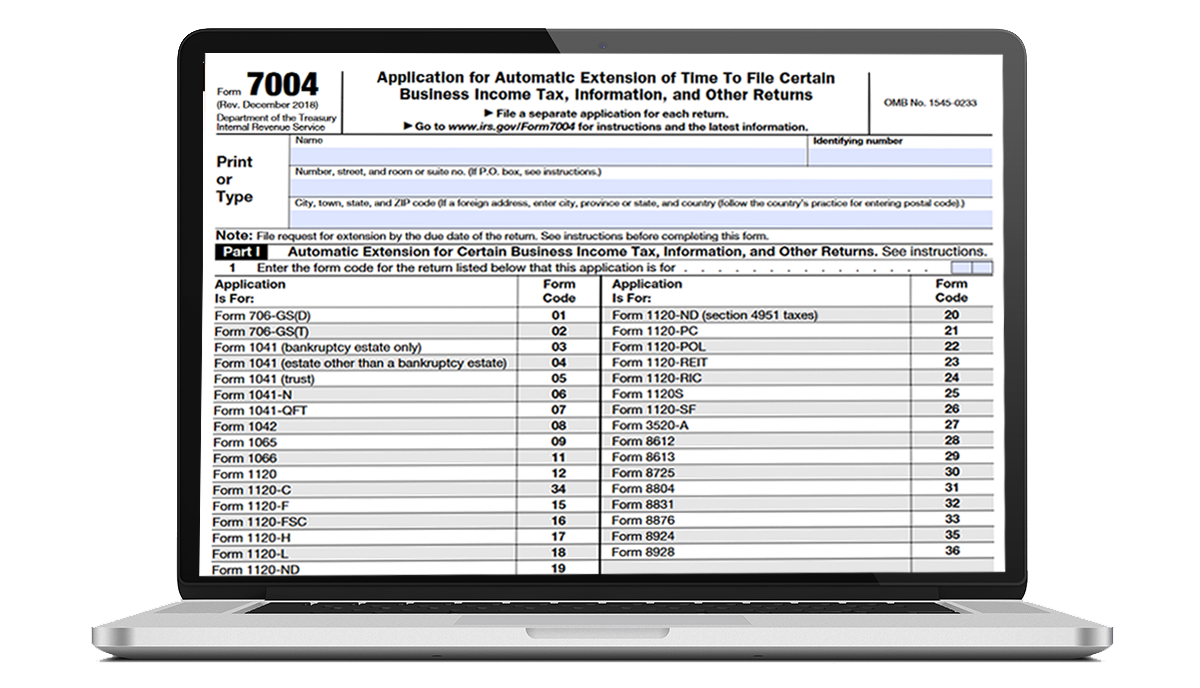

How to file an extension by mailĮxperts recommend filing online if possible, but you may choose to print and manually complete Form 4868 line-by-line using the IRS’ step-by-step instructions. The form offers different options for payment, including electronic transfer. If you think you’ll owe money when you file, you should submit a payment when you file for an extension, too. Any taxes you owe after April 18 will be subject to interest, which accrues daily, as well as monthly penalties. If you owe the IRS money, you’re still obligated to pay by April 18. That’s not true at all,” says Cagan.īut you should remember that this is a filing extension only.

“A lot of people think that if you file an extension, somehow that puts you at risk for an audit or you get in trouble for filing an extension. Otherwise, an extension is a good option.

Tax extention filr for free#

If you’re ineligible for Free File, you can use an online third-party service such as TurboTax or H&R Block, or submit your return by mail, as long as it’s postmarked by April 18. You can complete your tax return and submit payment online via the IRS’ Free File service, which is available to filers whose income is $73,000 or below. However, if you are able to file and pay your taxes owed today, do it. Anyone can apply for an automatic extension by filing Form 4868 through the IRS Free File software. NBCUniversal and Comcast Ventures are investors in Acorns Grow Incorporated.If you need more time to file, request an extension from the IRS to delay your due date until Oct. Copyright © 2022 Acorns and/or its affiliates. “Acorns,” the Acorns logo and “Invest the Change” are registered trademarks of Acorns Grow Incorporated.

Acorns Advisers, Acorns Securities, and Acorns Pay are subsidiaries of Acorns Grow Incorporated (collectively “Acorns”). Acorns Pay, LLC (“Acorns Pay”) manages Acorns’s demand deposit and other banking products in partnership with Lincoln Savings Bank, a bank chartered under the laws of Iowa and member FDIC. (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Brokerage and custody services are provided to clients of Acorns Advisers by Acorns Securities, LLC (“Acorns Securities”), a broker-dealer registered with the SEC and a member of the Financial Industry Regulatory Authority, Inc. Securities and Exchange Commission (“SEC”). It is not possible to invest directly in an index.Īdvisory services offered by Acorns Advisers, LLC (“Acorns Advisers”), an investment adviser registered with the U.S. The results of any hypothetical projections can and may differ from actual investment results had the strategies been deployed in actual securities accounts. Forward-looking statements, including without limitations investment outcomes and projections, are hypothetical and educational in nature.

Tax extention filr professional#

Please consult with a qualified professional for this type of advice.Īny references to past performance, regarding financial markets or otherwise, do not indicate or guarantee future results. Acorns is not engaged in rendering any tax, legal, or accounting advice. The contents presented herein are provided for general investment education and informational purposes only and do not constitute an offer to sell or a solicitation to buy any specific securities or engage in any particular investment strategy. All investments involve risk, including loss of principal.

0 kommentar(er)

0 kommentar(er)